All posts in Tax News

What Would a National Sales Tax Mean for the U.S.? {Slideshow}

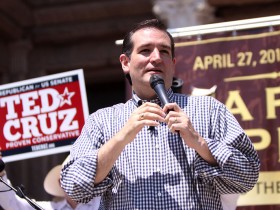

Over the past decade, the U.S. tax code has become increasingly complex and contentious. Supporters of the Fair Tax Act hope to change this. Cosponsored by Senator Cruz in 2013 and 2015, the Fair Tax Act calls for the an […]

IRS Announces New Joint Effort to Protect Taxpayers From Identity Theft

The International Revenue Service is joining forces with state tax officials and representatives of tax preparation firms to combat a new wave of tax-refund theft and identity fraud. This collaborative effort comes as a result of the agency’s recent announcement […]

Bermuda Takeovers Halt After Tax Scrutiny

The IRS discourages bidders from partaking in offshore takeovers to receive inappropriate tax breaks. This scrutiny has caused potential suitors looking to acquire foreign reinsurers to back out from merger deals. Bermuda-based reinsurer, Montpelier Re Holdings Ltd., has admitted that […]

Tax Filing Trauma: Roundup of Rants, Insights and Critiques

So, anyone else still feeling exhausted, stressed and/or traumatized from tax filing last month? For those of you still reeling and wanting to vent about the American tax code, here are some of our favorite tax rants, critiques, and insights […]

Polls Show Majority of Americans Oppose Death Tax

This April, the House voted to repeal the current federal death tax. This vote was met with the President’s threat to veto the repeal. The repeal had widespread support, with several Democrats even voting in its favor. However, it is […]

Separate Your Business and Personal Finances to Avoid Tax Trouble

Business owners often end up intertwining their business and personal finances. It may seem that you are your business but interweaving both of these two aspects will create a mess at tax time. Even if your company is a start-up […]